BBB: The Truth Gets Its Boots On

The blatant lies of the Left about Medicaid and SNAP (food stamp) reforms in the "Big Beautiful Bill" have gotten halfway around the world. It's time for the truth to get its boots on.

“End of Medicaid as we know it.” “People will literally die.”

Those are just a few of the words from US House Democratic Leader Hakeem Jeffries (D-NY) during the debate over HR1, the “One Big Beautiful Bill” (BBB) that President Donald Trump signed into law on Independence Day after it was rushed through the House and Senate over the past few days in marathon sessions. I didn’t expect it to pass so quickly, or the House to accept the Senate’s changes.

After all, as the old cliche goes among us Capitol Hill oldtimers, Republicans in the House consider Democrats to be the opposition; the Senate is the enemy.

Uber-lefty newspaper editorial writers jumped in, like this from the Tulsa (OK) World, a Gannett-owned newspaper: “Medicaid cuts and food assistance reductions in this legislation mean hospitals will close in Oklahoma and more children will go hungry.”

Then there’s this from 86-year-old actor and noted political philosopher, Morgan Freeman, on X, who now claims he is seeking “asylum” in Canada:

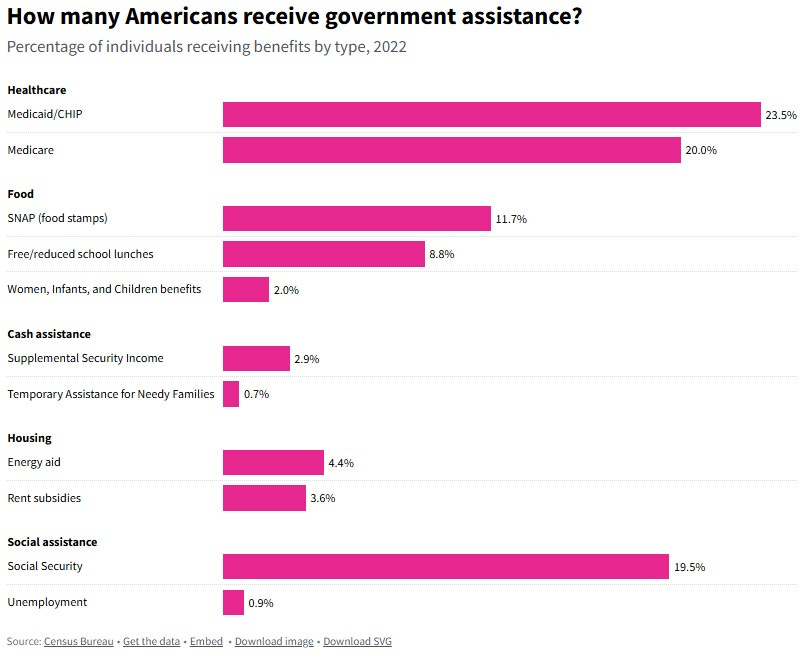

I did not realize that half of America was on Medicaid. Oh, wait, they’re not.

The number is closer to 82 million, which is still pretty high. Half of American children participate in Medicaid. But even then, I’m trying to figure out how increasing Medicaid spending by 30 percent over a decade is going to “end Medicaid as we know it” or kill everyone on Medicaid, especially after congressional Republicans sweetened a $50 billion pot to help subsidize or support roughly 1,800 rural community hospitals.

It’s time to pop the misinformation bubble. And that’s putting it too kindly. The bald-faced lies and gaslighting from so many Democrats and their media and special interest allies on the “Big Beautiful Bill” are an insult to the intelligence of Americans, whatever you think of the legislation (and I’m not a huge fan).

The lies themselves are a problem, of course, but it’s their consequences that are especially troublesome. The gullible among us actually believe them (or, at least want to, given their MSNBC-oriented delusions), along with the many false or grossly misleading stories of deportations of American citizens, or the failure to fully disclose the “heartwrenching” stories of illegal migrants, many of whom have committed crimes, being “ripped” from American families. Stories of their crimes or court-ordered deportations are buried on jump pages deep within poorly read newspapers. Studies show that most Americans never make it past the sixth paragraph of news stories, and the media is likely to bury essential facts if they are shared well after that.

Remember, the media today is often indoctrinated to focus on “who” or which favored interest group benefits rather than a relentless pursuit of truth and trusting people to make their own judgments.

It’s time for the truth about the legislation, warts and all, to get its boots on. And it’s long past time for political rhetoricians to stop spreading lies and start showing some respect for truth, facts, and people’s intelligence. The Trump Administration, and especially congressional Republicans who supported this bill, need to be more aggressive and effective in their communications and prepared to take corrective action as unintended consequences begin to emerge. Rhetorical excesses to match those of Democrats are not necessary.

If a second budget reconciliation bill emerges later this year, which seems likely, that would be a good place to include them. The apparent promise of another reconciliation bill, with expedited time and subject limits but exempt from the Senate’s filibuster, was made to help win the votes of those who wanted to cut more spending. It may also be used to make “technical corrections” to the Big Beautiful Bill. Getting that passed will be a challenge. More likely are a rash of spending rescissions before the fiscal year ends on September 30th and a new round of executive orders. We’ve yet to learn of all the promises made to win over recalcitrant legislators, but the ones I’ve learned are borderline obscene, especially involving Alaska.

Medicaid

The biggest lies, of course, are on reforms to the federal and state government’s health care program, Medicaid, for certain classes of people with limited income - the poor. They include pregnant women, families with young children, and the disabled. Senior citizens over 65 have Medicare, but the poorest among them also get help from Medicaid.

There are experts way more knowledgeable than I on health care policy and programs, and it is entirely possible, even probable, that I’m unaware of the Big Beautiful Bill’s genuinely negative impact on parts of the Medicaid population. A few have subscribed here, and I invite them to correct or educate me (and you) on the consequences of the legislation, whether intended or not. There will also be unintended consequences, as often always happens with significant and sweeping legislation like this.

I am not an expert on the challenges that America’s rural community hospitals face or all their issues with the BBB. I am aware that it is almost impossible for someone on Medicare and perhaps Medicaid to find a doctor who will accept new patients in many rural areas. Reimbursement rates for medical providers are not great under Medicare, and Medicaid reportedly pays 22 percent less. But they are complaining a whole lot less now that a $50 billion taxpayer-funded rural hospital fund has been created. House and Senate members are most concerned with the impact of Medicaid reforms (I refuse to call them “cuts” when they aren’t). Between Medicare, Medicaid, the Federal Employees Health Benefit Program (FEHBP), and other programs, the federal government now covers 40 percent of all healthcare spending.

But the facts tell a very different story from the tales being spun by alarmists.

It’s essential to understand that Medicaid is a program administered by states and heavily funded by federal taxpayers. States ultimately determine eligibility standards. There are three reforms in the legislation that are being demagogued. They include 1) enforcing eligibility standards and eliminating illegal migrants from the program, knocking off about 1.4 million people. Medicaid was never intended for people who weren’t lawfully admitted to the US. States can find alternative ways to provide care for that population, or people who aren’t supposed to be here can self-deport.

2) Another 8 million or so able-bodied 18-64-year-olds in Medicaid have to be gainfully employed or involved in education and training, “community engagement,” or service programs at least 80 hours per month, or on average, 20 hours per week. Why should you and I have to pay for these people’s welfare? House Democratic Leader Jeffries and every Democratic Member of Congress think so. I’m persuaded that Democratic leaders have a mission to make as many people as possible dependent on federal largesse so that they can fearmonger about loss of benefits come election season to lock in votes. Democratic candidates have been demagoguing that with Social Security for decades.

These work requirements are less stringent than those signed into law for welfare programs by Democratic President Bill Clinton in 1996. If anything, Republicans went soft on them in the Big Beautiful Bill.

That helps explain why we have a $36 trillion and growing federal debt, although both major parties and too many Americans and special interests with their hands out also deserve blame. And, by the way, most of these Medicaid reforms won’t take effect until after the 2026 elections.

3) The legislation modifies what is accurately described as a money laundering scheme where states assess a fee to medical providers for participating in Medicaid, then turn around and launder the money right back to them. Doing so allows them to inflate their federal matching funds, which some states also use to balance their budgets, including New York.

“It’s hard to think of a bigger government-sanctioned racket than Medicaid provider taxes,” opined the Wall Street Journal. “States pioneered these during the 1980s to obtain more federal Medicaid matching funds and reduce spending on the program from their general tax revenue. The free lunch has enabled states to expand benefits and greatly diminished the incentive to operate the program efficiently.” The Bush Administration proposed reforms, and even most Democrats, including former Speaker Nancy Pelosi and current Senate Democratic Leader Chuck Schumer, voted in favor of them; however, states have found ways to circumvent them.

The Congressional Budget Office also estimates that an additional 2.2 million may be dropped from Medicaid due to the legislation’s requirements to increase the frequency of eligibility verification. This needs to be stressed: Thanks to the Senate’s Byrd Rule, no policy changes to Medicaid or anything else were included in the bill (despite the best efforts to do so). The so-called “cuts” are designed to remove people who are ineligible for Medicaid from the system. Total savings anticipated add up to roughly $895 billion, but again, that’s just reducing the anticipated increase of about 30 percent over the next decade. Medicaid spending has increased by 60 percent since 2019, particularly since the massive Medicaid expansion, part of the Affordable Care Act (Obamacare), began to take effect about a decade ago.

One interesting conspiracy theory is that blue state Democrats are mostly upset because now, they’re going to have to find a way to pay for health care for all the “undocumented immigrants” they’ve been importing to pump up their census count to save congressional seats and protect population-based federal funding formulas.

SNAP

Another significant misconception surrounds similar reforms to the Supplemental Nutrition Assistance Program, or SNAP, which was formerly known as food stamps. Congress also imposed work requirements for able-bodied SNAP recipients, whose benefits for a family of 5 can exceed $1,000 per month, but typically run closer to $200 per month based on an income and assets test.

“Under the new plan, more people are also required to prove they are working, pursuing an education, or are in a training program to qualify for food assistance,” reported the left-leaning The Hill newspaper of Capitol Hill. “Currently, able-bodied adults between the ages of 18 and 54 have to meet these work requirements to get food stamps for more than three months. Under the bill, those requirements would extend up to age 64.” Previously, it was age 54. The projected savings over 10 years, compared to what would otherwise be anticipated, are $295 billion. As with Medicaid, total SNAP spending would continue to increase, albeit at a slower rate. States would pick up 5 percent of benefit costs, which they currently pay nothing for, and 75 percent of administrative expenses, up from 50 percent.

“Only 28% of able-bodied adults on SNAP work,” wrote the White House. “The One Big Beautiful Bill promotes work, responsibility, and restores SNAP to serve the truly needy. SNAP enrollment remains high even in a strong economy, including millions of able-bodied adults who could work. In fact, almost three-quarters of able-bodied adults without dependents on SNAP have no earned income. The mission of the program has failed. SNAP was intended to be temporary help for those who encounter tough times—we are strengthening this program to serve those who need it most.”

Increasing the Public Debt

The federal government’s public debt is an astronomical $36 trillion and growing, exceeding the total annual value of goods and services (Gross Domestic Product) produced in the United States. The BBB raises the debt ceiling to $41 trillion, having already hit the current limit. We are officially a debtor nation, with the public debt having grown by nearly $7 trillion during the Biden Administration and likely increasing by another $1 trillion or more this fiscal year. The interest payments on that debt are expected to exceed $1 trillion this year. It is not only unsustainable, but to paraphrase former House Speaker Paul Ryan (R-WI), the slowest moving train wreck in world history.

The “official” estimates, produced by the CBO, suggest that under the Big Beautiful Bill, the debt will increase by an additional $3.3 trillion over the next decade. But that depends on which “baseline” you use to estimate the deficit. “CBO will always predict a dark future when Republicans propose tax relief – but the reality is never so dire,” wrote US Rep. Jason Smith (R-MO), chair of the tax-writing House Ways and Means Committee. “CBO’s own fiscal year 2024 numbers reveal that corporate receipts came in at $529 billion, exceeding CBO’s $421 billion prediction made after the passage of the 2017 Trump tax cuts.”

“The drastic difference depends on which budgetary baseline is used: the current law baseline, always used to calculate tax cut impact on the deficit, or the current policy baseline, always used to calculate federal spending impact on the deficit,” explained justthenews.com.

As every planner will tell you, a lot of assumptions go into making estimates, and they’re often woefully imprecise. I prefer to call them guestimates. Some Republicans, using a “policy” versus “current law” baseline, estimate that the actual deficit over the next decade will be closer to $441 million. We’ll see.

Interestingly, Democrats were muted on the tax provisions because they know their “no” votes make them vulnerable to the charge that their opposition would lead to a $4 trillion tax increase across the board on nearly every working American and an economic recession. But they still call it a “tax cut for the rich.”

It depends on how you measure it. As a percentage of taxes paid, lower and middle-class Americans fare better than wealthier ones. In actual dollars paid, the numbers are larger for the rich, as they pay the vast majority of income taxes. More than 86 percent of all federal income taxes are paid by those making $100,000 per year or more; those earning $1 million or more annually pay a third of all federal income taxes.

Several programs, other than Medicaid, will receive more federal resources under this bill, including the Department of Defense, even though their share of spending as a percentage of GDP will continue to remain low, and the Department of Homeland Security, especially Immigration and Customs Enforcement (ICE), which will become the largest federal law enforcement entity in America over the next decade.

Bye Bye, Renewable Energy and Electric Vehicle Tax Credits

Additionally, decades-old tax subsidies for renewable energy will be scaled back, again starting after 2026, and Congress has imposed faster timelines for existing projects to be initiated and completed. The use of renewable energy has increased over the past 20 years, but it still accounts for only 8.2% of total energy production. And because wind and solar aren’t reliable (there’s no production when the sun isn’t shining or the wind isn’t blowing), overreliance can result in brownouts and disruptions. Thus, wind and solar tax credits are phased out. The $7,500 tax credit for buying electric vehicles ends on September 30th.

After reading all this, whether you agree with my characterization of the facts or not, does it sound like half the American population is going to die? Of course not. But the outrageous lies and gaslighting we’ve been showered with would have you believe that.

The more I read about the bill, the more I like it. I do not like the $325 million expense in the bill to relocate a Space Shuttle from the terrific Udvar-Hazy Air and Space Museum near Washington’s Dulles Airport to Houston, Texas, a bit of pork infused by US Sen. Ted Cruz (R-TX). I wish the junior Senator from Texas and chair of the Senate Commerce, Science, and Transportation Committee would focus more time and attention on replacing antiquated flood warning systems in the Hill Country of Texas, per the awful tragedy we’ve read about this weekend where more than 80 people, mostly young girls, were swept away by tragic floods. I bet $325 million invested in better flood warnings in Texas would have saved lives. Our hearts go out to the families and the victims.

I would also phase out the renewable energy and electric vehicle tax subsidies much quicker. I would go further in reducing out-of-control Medicaid spending by scaling back the ill-advised Obamacare expansion. But otherwise, it’s a good start.

Republicans need to help the truth get its boots on and allow it to catch up to the lies and gaslighting we’ve been showered with.

Now, let’s help wean millions of Americans and special interests off their fentanyl-like addiction to federal spending—that’s our real challenge, and it’s a massive scandal, especially when you realize how so many federal programs have turned into gravy trains for The Left™.

Tell the BIG LIE early and often...soon it becomes the "truth" to many.