Not Beautiful: One Big Bloated Bill

With credit to CATO's Romina Boccia for a more truthful title to HR1, the US House's budget reconciliation bill, let's hope Senate Republicans don't ignore the elephant in the room.

“What keeps you awake at night?”

That was the ending question of a recent “Zoom” call with old friends and colleagues, which we hold every few months to discuss politics. Being a follower of Christ, I’m admonished not to worry (Matthew 6:25-34) or be anxious (Philippians 4:6). The Bible says “fear not” or “do not fear” about 70 times. I’m usually asleep within seconds of my head hitting a pillow at night.

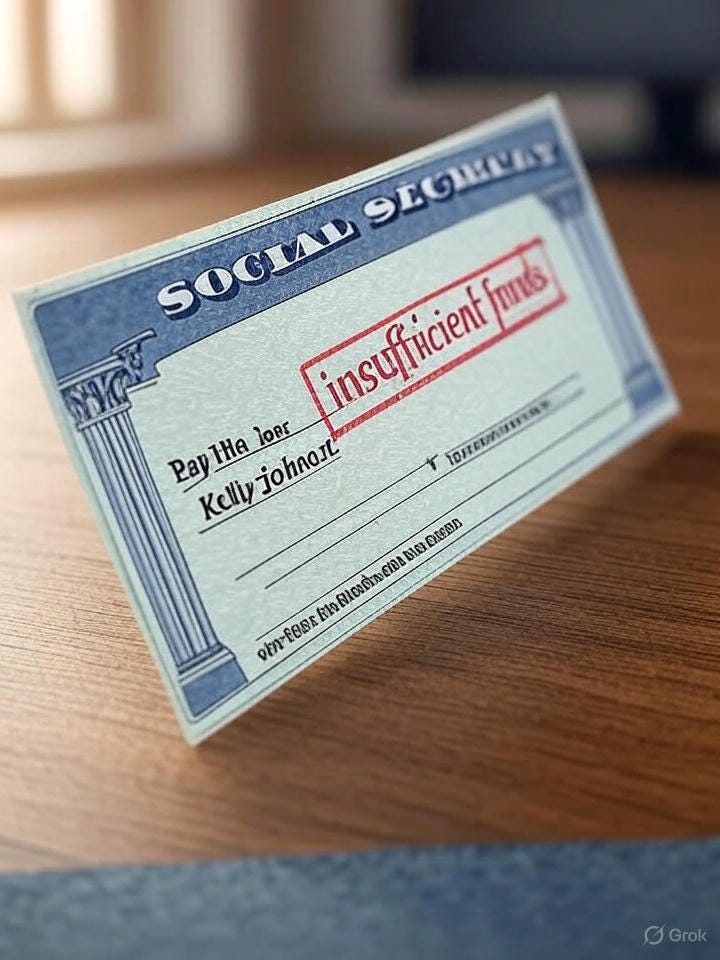

But I had a quick answer to the question: Our $36 trillion and growing federal debt, which I see rising to $50 trillion in just a few short years, after Social Security and Medicare likely go bankrupt. Our public debt exceeds our Gross Domestic Product (GDP), the value of all goods and services produced in the United States. And the public debt doesn’t even include the government’s unfunded liabilities, which now extend well into the hundreds of trillions, depending on what you count. This sets the stage for several bad things, from hyperinflation to massive interest rates and economic calamity, leading to an inevitable default on that enormous government debt. That would make the Great Depression look like a Hollywood birthday bash. One needs to look no further than the history of Zimbabwe and a few other countries.

I didn’t stop there with what keeps me awake at night. I also worry about the nearly $1 trillion annual cost to service that debt—forget about paying it down. If it weren’t for the cost of servicing the debt, we’d be tantalizingly close to a balanced federal budget. Servicing that debt now exceeds what we pay for our national defense, itself no examplar of government efficiency. Only Social Security and Medicare cost more (and are rising faster), with Medicaid, the government health care welfare program, shared with the states, catching up quickly. That is in part thanks to Obamacare, which in 2010 offered to pay states 100 percent of the cost, later dropping to 90 percent if they expanded a bloated and inefficient welfare program that some states have used to help balance their budgets—many of us warned of the consequences.

To borrow from Obama’s former Chicago pastor, Jeremiah Wright, the chickens have come home to roost.

Forty states took the deal and are worried about meeting their spending obligations, with their paltry 10 percent cost share. The ten states that didn’t are not complaining since the federal government continues to pay 100 percent of their Medicaid costs. They were the smart ones.

My friend Charles Blahous, of George Mason University’s Mercatus Center and a former Social Security and Medicare trustee, has written impressively and accessibly about the urgent need to reform Medicaid (and Social Security and Medicare, too). Meanwhile, that’s not stopped left-wing organizations sympathetic to, if not part and parcel of, the Democratic Party from spewing the usual refrain that “people will die” if Medicaid spending is brought under some modicum of control, even as it still expands.

“These hyperbolic assertions are typical of what happens whenever lawmakers make a serious effort to deal with the federal government’s unsustainable fiscal situation,” Blahous wrote. “The attacks may be politically effective, but they are substantively wrong. Slowing Medicaid’s cost growth is a policy imperative, and there are many ways to do so that would actually strengthen the program’s capacity to serve needy populations.” Sadly, responsible rhetoric is in short supply these days, and cannot be found in the House or Senate Democratic Conferences of the Congress, and increasingly less so on the other side of the aisle.

Except for Medicare, none of those massive drivers of public debt are being touched by HR1, Trump’s self-proclaimed “big beautiful bill” that passed the US House on a razor-thin 215-214 vote this past week. One Republican, House Freedom Caucus Chair Andy Harris (R-MD), voted “present,” and two other members, Andrew Garbarino (NY) and David Schweikert (AZ), fell asleep and did not wake up in time to cast their votes.

Sleeping on the job is not a very good reelection campaign strategy, and shame on their staff for failing to do their job. Do they not serve caffeinated beverages in the House cloakroom?

Another bit of inside baseball. A good “whip” operation, currently led by House Majority Whip Tom Emmer (R-MN), would have known where every member was and made sure they were awake and present for the vote, if only for their protection and to make sure they had the cushion for any last-minute surprises. They should plant an Apple Air Tag or Spotminders Card - even ankle bracelets - on every member to track where they are. They already have their cell phone numbers. Maybe they can work with Tim Cook at Apple on a way to remotely set their smartphone alarms. You think I’m joking? I also remember when House Members would look out for their colleagues.

HR1 (119th Congress), as passed by the House, features many positive attributes, especially on the tax front. Manufacturers and businesses of all sizes are thrilled. It modestly imposed work requirements on able-bodied Medicaid beneficiaries—at least 20 hours per week—while the program’s spending still grows. Over Democratic objections, it also forces citizenship verification that could remove an estimated 1.4 million noncitizens from the program. It also ends the Biden-era expansion of making Medicare cover gender transitions for eligible children (an estimated 60 percent of children are enrolled in Medicaid). Taxpayers have no business subsidizing those surgeries, especially for children.

It also phases out way-too-generous tax credits for electric vehicles (EVs) and renewable energy. To great applause from me, it also imposes a first-time annual fee for electric ($250) and hybrid ($150) vehicles to replenish the federal highway trust fund, which is hanging on by a thread and may go bankrupt by 2028. That fund, used to provide federal funds for highway construction, is paid for by fuel taxes that EVs don’t pay. If anything, EVs, which are notoriously heavier and thus cause more road and bridge wear and tear, should pay more. We’ll see if these provisions survive the Senate, where those EV and renewable energy credits are more popular. Imposing such a fee is better than creating an annual mileage-per-vehicle fee, which would be onerous to implement and possibly invasive.

The bill also finishes the border wall, allows hiring more border agents, and makes an overdue down payment to modernize our antiquated air traffic control system. The new “MAGA” accounts for children sound interesting, and borrow from an idea proposed by Democratic US Sen. Cory Booker (D-NJ) to establish and contribute to “baby bond” accounts for newborns. But don’t look for Booker to support it in the Senate.

If you want to trigger Democrats, make MAGA accounts available for unborn children.

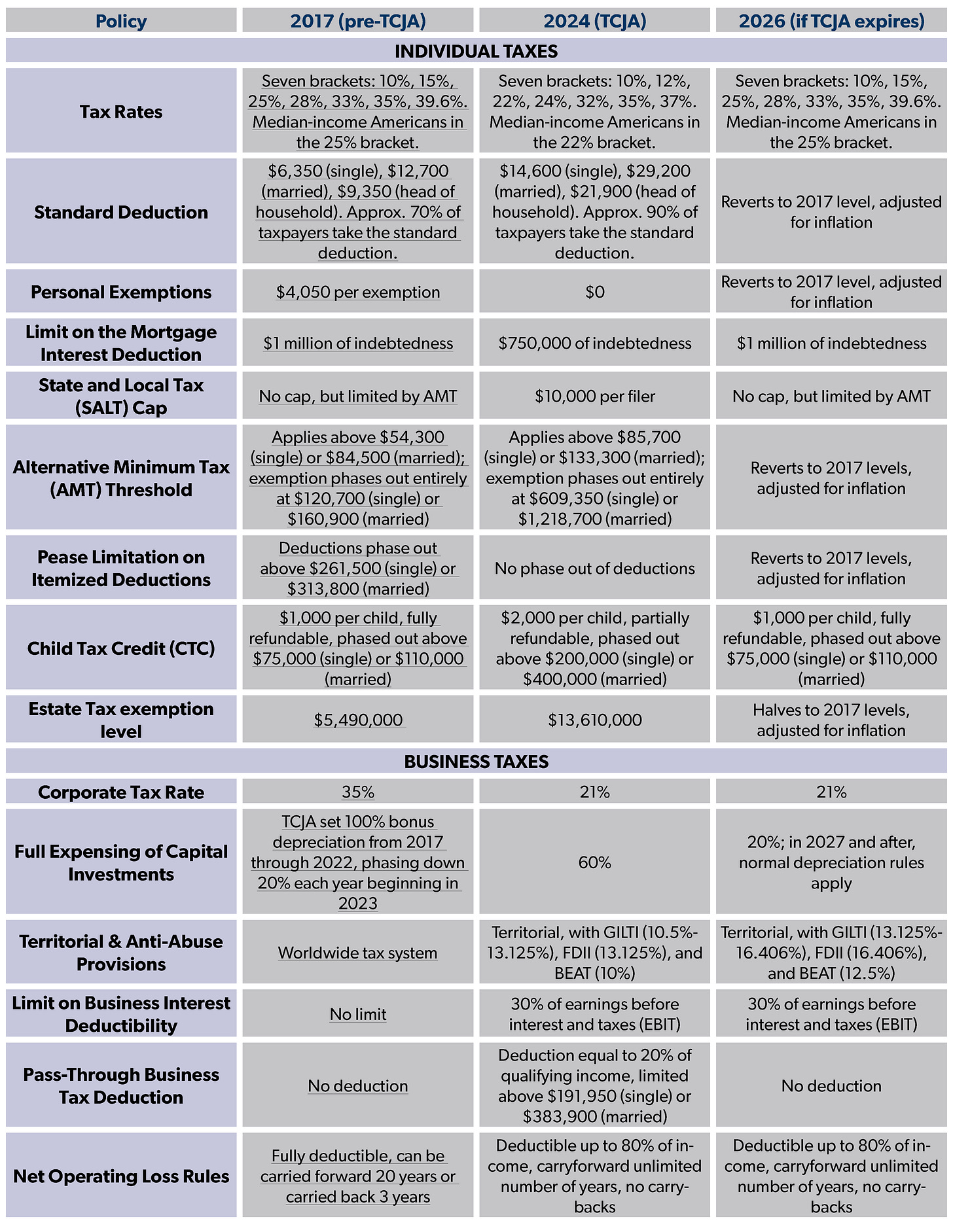

The best attributes of the “Big Beautiful Bill,” of course, are making permanent several provisions of the Tax Cuts and Jobs Act of 2017. That includes locking in reductions in most of the seven income tax brackets, which spread economic tax relief across the board, and my favorite, a dramatic increase in the standard deduction to make filling out those annual tax returns less painful. Congressional Democrats and their allies still falsely assert that it was a “tax cut for the rich,” but IRS data proves the benefits mostly fell on working, middle-class Americans.

“In fact, every income bracket with filers earning $200,000 or more increased its tax burden in 2018 compared to 2017, and every income bracket with a top limit lower than $200,000 paid a smaller proportion of the total personal tax revenue collected,” wrote Justin Haskins of The Heartland Institute in The Hill newspaper. “That means that Republicans’ tax reform law resulted in the tax code becoming slightly more progressive — the exact opposite of what Democrats have claimed over the past four years.” There are also a few more new tax reductions, including no taxes on tips and overtime hourly income, which will be met with cheers from many service workers, and new credits for lower to middle-income retirees.

Those are likely to survive whatever changes the Senate demands. We’ll see about the rest.

However, while setting targets for spending cuts over 10 years at $1.6 trillion, the House-passed bill sends defense spending over $1 trillion annually and increases public debt by another $5 trillion. Given the urgent need for a new class of submarines and to catch up with boat and plane construction from Communist China, these defense investments are essential, as long as they’re coupled with significant procurement reform that might reduce costs and get them into service faster.

My problem with the bill is that it refuses to address the elephant in the room - the massive drivers of growth, Social Security and Medicare, and doesn’t do nearly enough to curb Medicaid growth. More than 70 percent of federal spending is out of Congress’s touch in the form of entitlement spending, from “food stamps” (Supplemental Nutrition Assistance Program) to the Low Income Home Energy Assistance Program (LIHEAP); they’re open ended, and Congress only “controls” about a quarter of “discretionary spending,” including the Department of Defense.

Another problem with the bill is the so-called State and Local Tax Deduction, or SALT. It used to be you could deduct all your state and local taxes from your federal tax return. To make the numbers work in 2017, the Tax Cuts and Jobs Act capped them at $10,000 per filer. As homeowner in southeast Pennsylvania at the time, which features among the highest property taxes in the nation, I took a hit, but I didn’t care - I wanted to keep the pressure on my state government (and those in other high tax states like New Jersey and New York) to reform government and reduce tax burdens.

The House bill, under pressure from a few malcontent Republicans in New Jersey, New York, and California, raises the SALT cap to $40,000 for filers making less than $400,000 when it begins to phase out. You can live comfortably for $400,000 in those high tax states with or without a SALT cap. Lifting the SALT cap truly qualifies as a tax cut for the rich (at least the upper middle class), since the average filer in New Jersey, for example, spends about $10,000 in state and local taxes. And besides, that’s what doubling the standard deduction was supposed to help achieve, so you didn’t need to itemize. In fact, under the “Big Beautiful Bill,” the vast majority of high-tax state residents won’t benefit from the SALT cap hike - just the wealthy who do itemize.

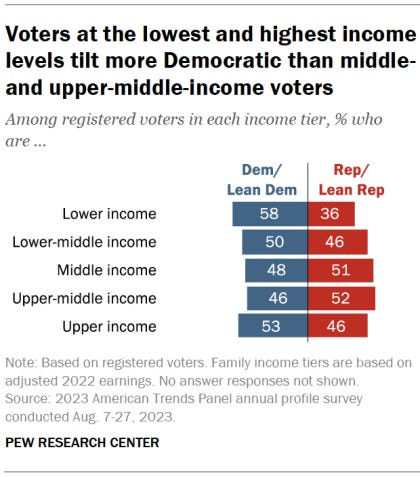

It’s obvious why our timid politicians won’t address the elephant in the room - both political parties, led by their presidential candidates in 2024, promised not to touch either Social Security or Medicare, even as they race towards bankruptcy in about a decade, if not sooner. And Democrats, in particular, are going to accuse Republicans of cutting entitlements anyway, just as they falsely accuse Republicans of only wanting to cut taxes “for the rich” (never mind how “the rich” are voting these days).

When that moment comes, medical reimbursements and retirement checks will likely be cut by at least 22 percent immediately. Doctors will stop seeing new Medicare patients, and current ones may find it challenging to make timely appointments. Many doctors in rural areas already refuse new Medicare patients. Those retirement checks for the seniors will no longer be monthly; they will be available only when enough money shows up from the backs of working people to cover monthly benefits.

In fairness, the so-called “Byrd Rule,” named after its author, the late Senate Democratic Leader Robert C. Byrd (D-WV) in the Senate prevents the budget and reconciliation process to be used for Social Security reform (the Byrd Rule doesn’t apply to the House, but it might as well); the benefit levels and formulas cannot be touched. It has to be done through legislation, which, given the legislative filibuster, requires bipartisanship. Yeah, I know, good luck with that.

But there is a way.

On these pages previously, I’ve called for making the now-almost defunct Department of Government Efficiency (DOGE) process similar to the Base Realignment and Closure commission and process (BRAC) that led to the closing and merging of dozens of military bases about two decades ago. Congress empowered commissions to devise a plan, which Congress was mandated to vote upon without the ability to amend. DOGE would have been far more effective if the President and Congress had pursued a similar, more bipartisan approach, resulting in rescissions (requiring a congressional vote and exempt from the Senate’s filibuster rule under the 1974 Budget Act) and fundamental spending reforms (some requiring Congress, others not). There are Democrats in Congress who clearly would support such a process, including those who initially signed up for the now-extinct House DOGE Caucus.

Since both parties in Congress and the President lack the courage and the political will to fix what ails Social Security and Medicare, we need a second BRAC-like commission to devise a rescue and reform plan for all federal entitlement programs. It should have been included in the House reconciliation bill - maybe the Senate can include it in their version in a way that passes muster with the Senate’s Parliamentarian. Give them until just after the 2026 or 2028 election to craft it, then force a vote during a lame-duck session between an election and a new Congress, or even the swearing in of a new President. The lame ducks have nothing to lose; let them take any political hit.

Make it a bipartisan commission that can’t include any current Members of Congress or government officials at any level, but instead includes former Social Security trustees, ex-agency administrators, and health policy experts and economists who understand what’s wrong, how to fix it, and the urgency of doing so without pushing personal agendas. I’d happily make my friend and former Senate Majority Leader Bill Frist (R-TN) and former Senate Democratic Leader Tom Daschle the respective cochairs. Both are public-spirited retired public officials who get along and have no professional agendas to peddle or axes to grind; they’re health care policy experts in their own right (Frist is a famous heart-transplant surgeon). The President would nominate chairs and commissioners on the advice and counsel of congressional party leaders, including letting Democrats pick their own, as they do now, various federal commissions, from the FEC to the FCC.

Some strict ethical provisions should include financial disclosures for up to a decade after completing the commission’s work, a lifetime lobbying ban, and outlawing any ability to profit from their prescriptions or public service. I’d agree to that if I could contribute to saving our country from a looming disaster.

I’m sure I wouldn’t like their final product any more than I like the “Big Beautiful Bill,” since it likely would include increasing payroll taxes and more “means testing” for both Medicare (my premiums are high enough, thank you) and Social Security retirement. But it beats whistling past the graveyard, which is what we have now. I’ve already volunteered to take a cut in my Social Security retirement benefits since, as a former “high earner,” I’m scheduled to collect a pretty big payout when I turn 70. Social Security was designed to keep people out of poverty, and that’s what federal entitlement programs are supposed to do, and no more. I bet you’d be surprised how many public-spirited seniors are willing to forgo some taxpayer-funded retirement funds to save the system by returning it to its original mission.

Democrats will happily tell you that getting rid of the “Trump Tax Cuts” from 2017 would raise taxes by an estimated $4 trillion and put us on a more fiscally responsible path. And that’s how they’ve voted both in 2017 and again this past week, for a $4 trillion tax increase. That presumes Congress would turn off the spigots they opened up during the Biden years, when they pumped $6-7 trillion new money into the economy, resulting in the highest inflation in 40 years (it’s back down now, thanks mainly to the Federal Reserve) and massive waste and fraud.

We don’t have a taxing problem - federal revenues have remained fairly historically consistent between 17-19 percent of Gross Domestic Product since World War II. However, federal spending has grown to over 23 percent of GDP in fiscal year 2024. My former boss, then-Rep. Jon Kyl introduced one of my favorite Balanced Budget Amendments. It would limit federal spending and revenues to 19 percent of GDP, requiring a two-thirds vote of Congress to exceed it or go into debt. It was the first bill Kyl, a future and now-former US Senator, introduced in his distinguished legislative career. It remains a terrific idea.

We have a spending problem, not a taxing problem. Raising taxes to 23 percent of GDP, even if Congress stopped spending more money (LOL), would cost thousands of jobs and dampen economic growth and opportunity. While it’s true the “Trump Tax Cuts” resulted in a temporary one-year reduction in federal revenues, they began to increase as their benefits kicked in. That’s another reason why getting a good tax bill done earlier is politically and economically beneficial - it takes time for the benefits to kick in.

Speaker Johnson deserves much credit for his patience and persistence in shepherding the “Big Beautiful Bill” through his diverse and petulant conference. My friend and Senator Majority Leader John Thune will have an even more challenging job in his chamber, where he and President Trump don’t have as much leverage over more independent-minded Senators. My former boss and Senator Majority Leader Trent Lott (R-MS) named his memoir, “Herding Cats: A Lifetime in Politics.” You think he was joking?

The Senate will now work its will and approach spending cuts and a few tax provisions differently. Look for tweaks to Medicaid reforms and the SALT tax limit, among other things, even as the tax provisions are likely to survive. And let’s hope they find a way to include a BRAC-like commission to make the tough decisions that no one seems willing to make. Sadly, I have little hope of that happening.

It’s time for a wake-up call for all worried about precious federal programs and funding. You’d be amazed at what your tax dollars subsidize, and at what level, from EV stations to nice-sounding programs run by local nonprofit agencies. The fact is that we cannot afford to solve every societal problem with taxpayer money. Some things will have to go, and well-meaning programs will have to find other sources of income to meet local needs. I’d start with repealing the bizarrely-named and pork-infused Inflation Reduction Act, which did anything but.

Every program needs a hairy-eyeball analysis of costs and benefits in the face of a roaring and ominous federal deficit and debt. That’s hard because every federal spending program has a constituency, and they know how to squeal and play political games. Cutting federal spending programs requires a spine, and they’re in short supply among our political class. Just ask Elon Musk, any corporate CEO, or a local government official who doesn’t have the power to print free money like Uncle Sam.

Until then, our massive, growing, and unsustainable public debt will threaten our future, especially our children’s and grandchildren’s.

That should keep us all awake at night.

Great article by a modern-day Cassandra (a person whose valid warnings or concerns are disbelieved by others). Paul Ryan once called the ever-growing debt the slowest train wreck in history. We all see it coming, yet no one is doing anything to stop it. When the day of reckoning occurs, no political leader will be able to say they were surprised.

Why is no one is congress vehemently screaming at the top of their lungs about the provision in the recent passed house Bill “One Big Beautiful Bill Act"/HR1 that grants TRUMP the power to subvert the rulings of the lower federal courts?

This is the whole enchilada. If this passes in the Senate there will be NO stopgaps. He can do whatever he pleases. Democracy is on life support, this is it. WE must stop this by all means necessary. THIS IS THE DEADLINE which cannot be crossed. PLEASE, speak to any and all media and all social media outlets.