Should Low Tax States Subsidize High Tax States?

The state and local federal tax deduction might be repealed, but phasing in a higher cap will likely be part of several trade-offs. Be careful what you wish for.

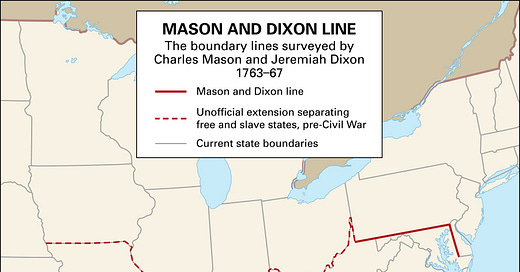

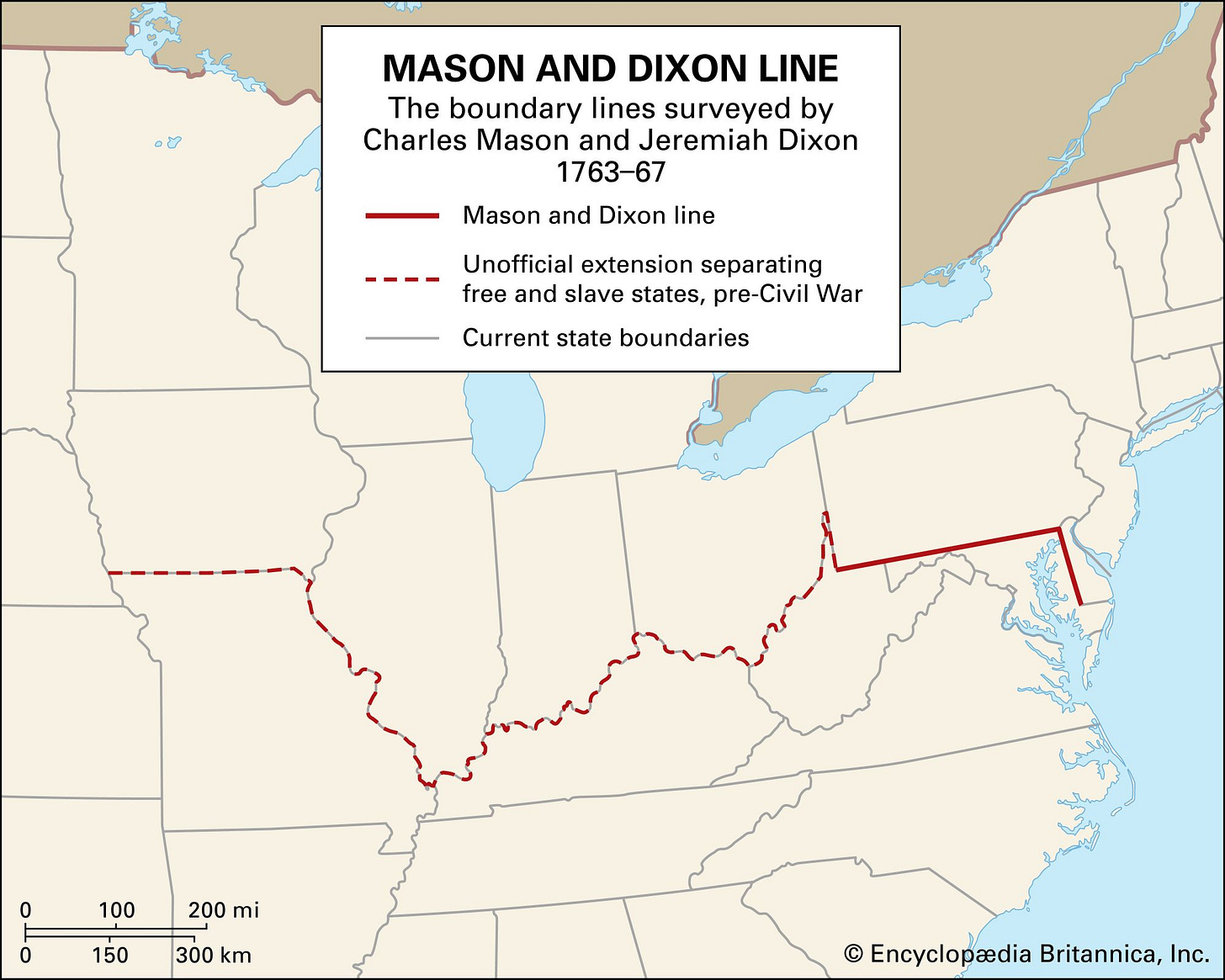

Immediately after the 2020 election, my wife and I moved from Delaware County, Pennsylvania, in the Philly suburbs, back to northern Virginia. The return trip occurred 18 years after our initial move across the Mason-Dixon line.

One of the biggest surprises about moving to Pennsylvania was their tax system. At least for individuals, their income taxes featured a then-2.85 percent flat income tax rate (Democratic Governor Ed Rendell led the effort to raise it slightly to 3.07%). Okay, that was fine, but the property tax bill was a surprise. I owned a lovely house on a small acreage (1.5 acres). My “school tax,” their version of a property tax to fund the local public school system, was more than $15,000 annually, almost three times higher than my Virginia property tax bill in lovely eastern Loudoun County. The total bill would grow to $18,000 by the time I left. And I was never happier to leave it behind.

It was even worse in neighboring New Jersey, where I worked. My realtor wife and I looked at homes on both sides of the Delaware River, which separates the Keystone and Garden States. Living in New Jersey would have cost us an additional $15,000 yearly in higher income and property taxes on smaller-sized properties. We opted for the other side of the river, as do most higher-income executives (unlike Pennsylvania, New Jersey has a steeply progressive income tax on top of higher property taxes, and they have an income tax reciprocity agreement). In fairness, you get more public services in New Jersey than in suburban Philly, whether you need or want them.

Former two-term US Rep. Jon Runyan (R-NJ), a former NFL legend with the Philadelphia Eagles and now the head of NFL Player Safety, once told me that his property tax bill in New Jersey exceeded $70,000. That was more than a decade ago, after a 2010 election controversy about him harboring four donkeys on his estate for an agricultural exemption to reduce his tax burden. He won anyway, unseating US Rep. John Adler (D-NJ) in a Republican landslide.

Much of the 2017 Tax Cuts and Jobs Act - the so-called “Trump Tax Cuts” - will expire in 2025, and their extension, plus a few other reforms, are perhaps the top agenda item for the incoming Trump Administration and the GOP Congress. New Jersey and many of the northeastern states' congressional delegations are leading a charge to lift the current $10,000 cap on state and local tax deductions on federal income tax returns. That cap was, for many, an irritating feature of the TCJA but demanded by tax writers like Ways and Means Committee Chair Kevin Brady (R-TX) from states with much lower state and local tax burdens.

Supporting that cap contributed to Runyan’s successor, former two-term Rep. Tom McArthur (R-NJ), narrowly losing reelection in 2018, a Democratic year. McArthur, who was close to then-Speaker Paul Ryan (R-WI), supported the TCJA after he learned the median state and local tax deduction in New Jersey totaled less than $9,000. He voted for the TCJA. Most other members of the Jersey congressional delegation voted no, despite evidence that it reduced tax burdens across all income groups, especially the middle class. And federal tax revenue, after taking a hit the first year, increased afterward, thanks to most of its pro-business provisions.

However, higher-income taxpayers vote, too, and they are enraged by the SALT cap. In 2018, McArthur narrowly lost to Andy Kim, who was elected to the United States Senate this year. Dr. Herb Conaway, a long-time Democratic state legislator, is the district’s new Congressman. He most assuredly will join the chorus to lift the SALT cap. Kim, of course, champions the SALT cap’s repeal. So are the few GOP members of Congress who represent districts in the northeast. Very few.

On the surface, the SALT cap seems unfair and exposes taxpayers to double taxation, paying taxes on income used to pay both state and federal taxes. That’s the argument for repeal. But it also means taxpayers in states with low or no state income or lower property taxes are paying an unfair share of federal taxes, which is “subsidizing” residents in mostly blue high-tax states. The TCJA dramatically increased the standard deduction, which simplifies tax filing and is designed to account for things like local sales and related taxes.

The 2017 Tax Cuts and Jobs Act (TCJA) imposed a $10,000 cap on SALT deductions, putting some of the most stringent limitations on the deduction in its 100-plus year history. The tradeoff for many taxpayers was a higher standard deduction, which TCJA doubled. Both the SALT limitations and the doubled standard deduction expire after 2025, putting SALT on the 2025 menu for lawmakers.

The Trump Tax Cuts also dramatically raised the exemption for income subject to the “Alternative Minimum Tax,” which limited the benefit of the SALT tax deduction. That AMT provision and the SALT cap are scheduled to expire at the end of 2025.

Both arguments have holes, but eliminating the cap masks the reality of excessive state and local tax burdens. Some locals will tell you they’d rather pay higher state and local than federal taxes because they see the “benefits,” such as they are.

But one thing is undeniable: Eliminating the SALT tax cap would be a tax cut for the wealthy. The cap would also incentivize state and local tax writers to keep their rates under control.

The reality will be that the House, where all tax legislation must begin under the Constitution, is closely divided. It will consist of 220 Republicans and 215 Democrats, assuming three upcoming House GOP vacancies will stay Republican after special elections (they probably will). Until then, it will be 217-215, a one-vote margin, until the vacancies are filled sometime next Spring. House tax writers must address demands for SALT cap repeal or reform.

The answer is phasing in or lifting, but not repealing, the SALT tax cap, perhaps to $20,000. That’s just a guess. Remember, Trump has made many other expensive promises, including no taxes on tips and exempting Social Security retirement checks from income taxes. Now that servicing the federal debt - never mind trying to pay it down - exceeds every federal program ($822 billion this fiscal year) except Social Security, that’s an issue. It’s unsustainable. Federal public debt is now an unfathomable $36 trillion.

Do you think inflation has been bad recently? You wait.

Here’s the reality. Those in high-tax states screaming for a SALT cap repeal should be prepared for trade-offs and whether they might be worth it. I like that only nine percent of filers itemized their simplified taxes last year. Before TCJA, it was 33 percent. Accountants everywhere are salivating at higher fees.

President Biden and congressional Democrats have also gifted us 80,000 new IRS agents. They’ll be watching you and more.

I’m oversimplifying things here, and much of this will play out through the budget and “reconciliation” process as it unfolds throughout the year. Look for Republicans to jam as much into this process as possible since it is not subject to the Senate’s supermajority filibuster and limits debate. I’m all for extending as much of the Tax Cuts and Jobs Act as possible. But for those looking for additional benefits, be careful what you wish for—especially those of you looking to repeal the SALT tax cap.

Cast a hairy eyeball at your governors and state legislators instead.

Why wasn't this an argument when people accused Trump of tax breaks for millionaires? This actually hits me pretty hard and I'm not rich by any US definition.

The SALT deduction subsidizes wasteful state budgets in one party blue states. It should be repealed entirely.

If that forces fiscal discipline or prompts migratory defection to red states that manage their budgets better, that's good too.