Nothing Is Certain But Death and Taxes. The IRS Can Deliver Both

"If Democrats have their way, one of the most detested federal agencies—the Internal Revenue Service—will employ more bureaucrats than the Pentagon, State Department, FBI, and Border Patrol combined."

In Orwellian Washington, DC-speak, a “budget reconciliation” bill is winging its way through Congress. Under the post-Watergate 1974 Budget Control and Impoundment Act, “reconciliation” bills have special status, especially in the United States Senate.

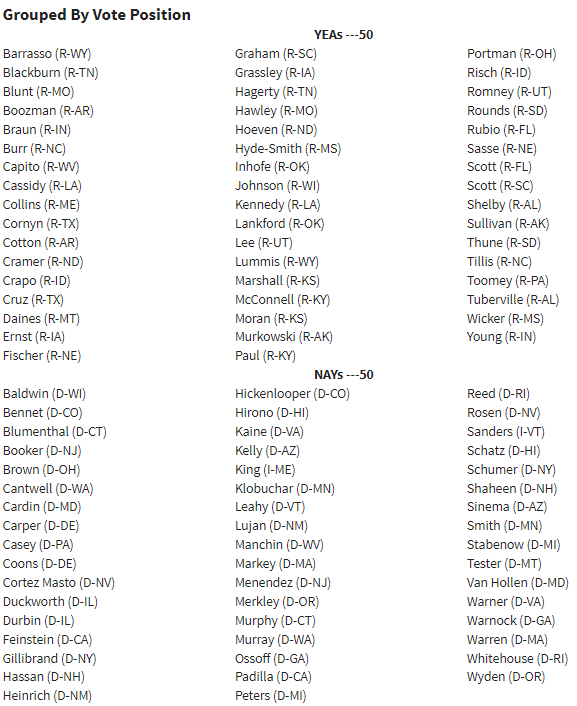

More Orwellian than calling it a “reconciliation” bill is its actual title: The Inflation Reduction Act. It does no such thing. But by the time you read this, it will likely have passed the Senate and is on its way to being rubber-stamped by a House narrowly controlled by Democrats and signed by a clueless, hapless, and compliant President. The Senate vote, I predict, will be 51-50, with Kamala Harris breaking the tie. There is always a chance a Senator won’t show up but don’t count on that.

Unlike most legislative items, reconciliation bills cannot be filibustered. A simple majority vote enacts them. Debate is limited to 30 hours. But it resembles a Faustian bargain. The bill (and any amendments) must strictly focus on permanent spending and tax programs - no “extraneous” provisions. Any attempts to mask policy issues as “revenue raisers” - such as raising the federal minimum wage to $15 per hour - are verboten unless a supermajority of 60 Senators says so.

For those reasons, our current very slim Democratic majority endlessly and aggressively tries to cram as many of its agenda items in reconciliation as possible. The Senate Parliamentarian gives the “reconciliation” bill a “Byrd bath,” so named for the late Senate Majority Leader who, in 1985, became concerned about abuse of the reconciliation process. He was prescient about his own caucus.

But Byrd baths and budget rules can’t fix all horrible big spending and tax provisions that have made their way into this horrific legislation.

Much has already been written about the 15 percent minimum corporate tax to allow Medicare, our nation’s largest government health care program, to “negotiate” (i.e., set) prescription drug prices. There are many other bad ideas, especially billions to fund so-called “green energy” programs, including wildly distortive tax credits for not-as-environmental-friendly-as-you-think electric vehicles. Owners of those heavier-than-gas-operated vehicles also pay practically nothing to maintain roads and bridges, funded largely through state and federal fuel taxes.

But one provision that is escaping much notice as a “revenue raiser” is $80 billion in new spending for the Internal Revenue Service to double its workforce, adding 87,000 new agents over the next 5 years. Ostensibly, this “investment” will result in $200 billion in new revenue by catching tax cheaters.

“If Democrats have their way,” the Washington Free Beacon reported, “one of the most detested federal agencies—the Internal Revenue Service—will employ more bureaucrats than the Pentagon, State Department, FBI, and Border Patrol combined.

“That would make the IRS one of the largest federal agencies,” the Washington Free Beacon added. “The Pentagon houses roughly 27,000 employees, according to the Defense Department, while a human resources fact sheet says the State Department employs just over 77,243 staff. According to the agency's website, the FBI employs approximately 35,000 people, and Customs and Border Protection says it employs 19,536 Border Patrol agents.

“The money allocated to the IRS would increase the agency's budget by more than 600 percent. In 2021, the IRS received $12.6 billion.”

Not to worry, says a statement signed by a “bipartisan” trio of former IRS Commissioners. (Emphasis added)

As former IRS commissioners, we have watched the agency closely over the years, and understand far too well that the status quo is not tenable: The IRS has a workforce that has shrunk to 1970s levels with technological infrastructure that is decades out-of-date and an audit rate that has dropped by 50 percent. The sustained, multi-year funding contained in the reconciliation package is critical to help the agency rebuild. That will mean vastly improved services for taxpayers, who will be able to interact with a modernized IRS in a digital way, whose questions will be answered and issues resolved promptly and fairly, and who will find it simpler to get access to the benefits and credits to which they are entitled. It will also mean the capacity to enforce the tax laws against sophisticated taxpayers who today evade their tax obligations freely, because they know that the IRS lacks the tools it needs to pursue them. To be sure, the vast majority of workers already pay what they owe, which is why the Administration has been clear that audit rates wouldn’t increase for families making under $400,000 annually. In fact, for ordinary Americans who already fulfill their tax obligations, audit scrutiny will decline, because the IRS will be better at selecting returns for examination. This bill is about getting to the heart of the problem and pursuing high-end taxpayers and corporations who today illegally evade their tax obligations.

“The Joint Committee on Taxation, Congress’s official tax scorekeeper, says that from 78% to 90% of the money raised from under-reported income would likely come from those making less than $200,000 a year,” reported the Wall Street Journal. “Only 4% to 9% would come from those making more than $500,000.”

The IRS’s data underscores the point. While people reporting income of at least $10 million annually face higher audit rates (about 12 percent in 2015), there are only 14,000 such wealthy Americans Meanwhile, the vast majority of IRS audits - nearly 600,000 - were conducted in 2015 on households reporting less than $50,000 in annual income. I’m sure the IRS finds it easier to audit people who don’t hire expensive lawyers and accountants who are experts in evasive tax strategies.

The problem may be less the enforcement of existing laws than their complexity. Congress is doing it all wrong, as usual.

Oh, and that promise by President Biden, Senator Joe Manchin (D-WV), and others that no couple making $400,000 or less will pay any new taxes? The Joint Committee on Taxation says no. They found that taxes would jump by $16.7 billion on American taxpayers making less than $200,000 in 2023 and raise another $14.1 billion on taxpayers who make between $200,000 and $500,000,” the New York Post reported.

To be sure, the IRS needs modernization. No doubt there are tax cheats out there who need to be caught. Maybe they are among the 14,000 or so filers who make $10 million. But the problem is our overly complex tax code results from wealthy interests who hire tax experts and lobbyists to protect or win the approval of favored provisions that they probably lobbied for.

And as we know, the IRS never makes any mistakes, especially when auditing taxpayers and small businesses.

Joan Smith, 52, a Philadelphia-based artist, was preparing to go in for spinal surgery in 2010 when the IRS put a $10,000 tax lien on her bank account -- which was more money than she had in the bank. It turns out she'd never received an audit memo that had been sent to her old address. She spent the next 11 months digging out from the paperwork avalanche that comes with a full audit.

Or this, from cheapism.com:

Bostonian Paul Hatz endured a five-year audit over the liability of his C corporation. To start, he was served with a $110,000 personal tax lien, allegedly because the auditor miscategorized money he’d invested into the corporation as income. He incurred $60,000 in attorney and CPA costs fighting the fine and was forced to shutter his small business, which had employed more than a dozen people. He’s since tried to appeal the results on grounds that the IRS never sent out the proper statutory notices of deficiency, denying him the right to challenge his auditor’s claims.

Tim and Tracey Kerin have a story via thestreet.com:

This couple experienced the ultimate nightmare. According to Tim, the IRS agent outright lied about her findings, because she didn't have time to go through the estimated 4,000 pages of documents they provided.

The audit was about the pair's company expenses, and they learned a costly lesson: Their CPA hadn't correctly evaluated their expense categories and they'd signed off on the forms without reading them thoroughly.

"A lesson moving forward is that every business owner should spend time with their CPA and bring their Quickbooks in and go over every expense account to make sure it complies with the current tax laws," says Tim. "Also, you should visit your CPA on a regular basis and not just at tax time when the year is already closed out."

But it was the audit itself that took the biggest toll. During the process, Tim says, he and Tracey learned that "you can have the Taxpayer Advocate Service (TAS) step in to resolve issues."

They reached out and the TAS called on their behalf, which irritated the IRS agent further.

"She complained to our CPA and notated how upset she was on our forms," Tim said. "By us doing this we upset the IRS agent so she put the screws to us even harder and ignored the TAS. Our civil rights are now gone."

Just a couple weeks ago, Tim and Tracey met with the Deputy Chief Council of the House Small Business Committee on Capitol Hill to argue their case.

"The Deputy Chief Council responded that this is unfortunate," Tim recalls. "Tracey said, 'Unfortunate is when my cat gets hurt! This is criminal.'" To date, Tim says, the two of them have spent more than 30 months and $95,000 in legal and accounting fees to defend their companies in an expense audit. "We now have to spend an additional $15,000 in appeals to defend ourselves against the lies of the IRS agent."

There are thousands more stories like this. Maybe you have one. I probably will after the IRS reads this.

What will the IRS do with all that new money? Will they use it all to hire new agents and upgrade their technology, or will they buy more ammunition? According to the fact-checking website verifythis.com:

Between March 1 and June 1, 2022, the criminal division of the IRS ordered $696,000 in ammunition, the IRS told VERIFY in an email.

The order was for the IRS Criminal Investigation (IRS-CI) division, which is a federal law enforcement agency that conducts criminal investigations including tax violations, money laundering, cyber crimes, and organized crime involving drugs and gangs. There are more than 2,000 sworn special agents in the division.

“Many of these cases are typically worked in conjunction with other state and federal law enforcement agencies. IRS-CI special agents have been carrying firearms throughout the more than 100-year history of the agency, and have found themselves dealing with some of the most dangerous criminals,” an IRS spokesperson told VERIFY.

In 2018, the U.S. Government Accountability Office (GAO) published a report on what the IRS spent on firearms and ammunition from 2010 through 2017. The data starts on page 75 of the report.

From 2010 through 2017, the IRS has spent an average of $675,000 on ammunition a year, the report shows. During that time, the IRS spent the most in 2011, with $1,100,000 in spending.

I yearn for elected officials who will fight for me, not for interests who hire lobbyists to win special tax provisions in exchange for large campaign contributions.

It appears to be a fait accompli, but make no mistake, this “reconciliation” bill is a disaster, a pure payback, and a giveaway by Democrats to favored constituencies and interests at our expense. The non-partisan Tax Foundation outlines their analysis, which I find persuasive:

Last-week’s Democrat-sponsored Inflation Reduction Act (IRA), successor to the House-passed Build Back Better Act of late 2021, has been touted by President Biden to, among other things, help reduce the country’s crippling inflation. Using the Tax Foundation’s General Equilibrium Model, we estimate that the Inflation Reduction Act would reduce long-run economic output by about 0.1 percent and eliminate about 30,000 full-time equivalent jobs in the United States. It would also reduce average after-tax incomes for taxpayers across every income quintile over the long run.

By reducing long-run economic growth, this bill may actually worsen inflation by constraining the productive capacity of the economy.

There’s no way these provisions make any sense, economically or politically. Democrats must realize that they will lose control of Congress in November and want to lock in as many benefits for their friends as possible while punishing their enemies (and even a few of their friends in the private sector). They are counting on Republicans being unable to fix or undo their provisions so long as a Democrat sits in the White House and can veto any future “reconciliation” bills.

Those worried about partisan behavior at the IRS have justification for their fears. Richard Nixon infamously used the IRS to target political opponents. And remember the Lois Lerner scandal from the Obama years for which no one was punished?

“The only difference between a tax man and a taxidermist is that the taxidermist leaves the skin.” — Mark Twain

In the meantime, get ready for that knock on the door from your friendly IRS agent. They have questions about your tax returns. And they have ammunition. After all, nothing is certain in this life but death and taxes. And the IRS, it seems, can deliver both. Thank your Democratic US Senator for sending them. And their ammo.